Perception of security, data protection, and excellence in customer experience: these are the three pillars that support a financial institution's reputation in the digital age.

In a market where trust is the main pillar, the rule is to be uncompromising with security while simultaneously offering simple, fluid, and increasingly personalized journeys. This recipe applies to a traditional bank like Itaú Unibanco, where reputation is anchored in the balance between innovation and responsibility, in the words of its Technology Director, Carlos Eduardo Mazzei. This also applies to C6, with the DNA of a digitally native bank, explains Gustavo Torres, head of User Experience and Innovation.

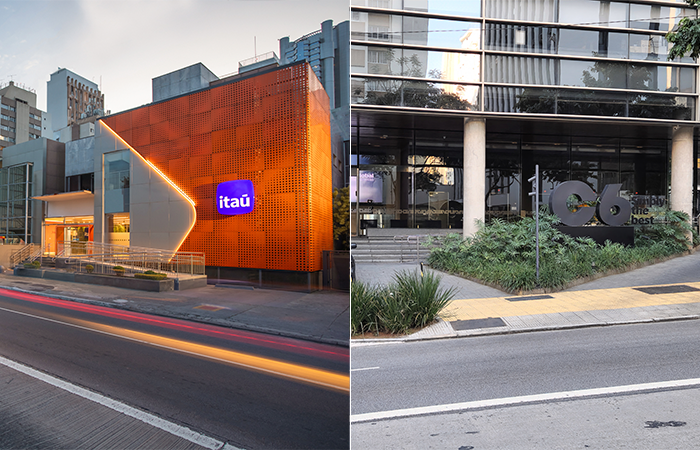

The ability to balance cutting-edge technology with security and personalized customer experience is what most captivates and builds loyalty in this area. Itaú, among traditional banks, and C6, among digital banks, were highlighted in the 2025 Digital Experience Ranking, one of the financial sector's leading assessments of customer journey, innovation, and digital trust.

67,69% point to reputation and security as the main motivators when choosing a bank, according to research by idwall

Held by IDWALL, which works in the area of technological innovation for companies in the sector, the survey interviewed 4,421 users from 21 financial institutions, 10 traditional banks and 11 digital banks.

Raphael Melo, co-founder and COO of idwall, explains that trust is established gradually, as the customer feels they are benefiting from the best offers, the relevant and responsible use of the data they consent to share, and, most importantly, the security of the transactions they carry out.

At Itaú, reputation is anchored in the balance between innovation and responsibility. "Besides security, which is paramount to our strategy, factors such as caring for our customers' financial well-being, offering hyper-personalized and contextual experiences, and providing agility and quality in customer service and services are increasingly crucial to a financial institution's reputation," says Carlos Eduardo Mazzei, Itaú's Chief Technology Officer.

“Trust is built day by day, with consistency, empathy and delivering real value to the customer.”

Carlos Eduardo Mazzei, Director of Technology at Itaú

Security, ethics and privacy standards

The hyper-personalization of services, driven by generative artificial intelligence, goes hand in hand with rigorous security, ethics, and privacy standards. "As the technology matures, we want to prepare ourselves to take full advantage of the scalable benefits it will enable, without losing sight of the human side of the coin to ensure real added value for our customers," Mazzei summarizes. He says the bank's operating mandala is based on three main pillars: quality, speed, and efficiency.

With the DNA of a digitally native bank and a reputation reinforced by JP Morgan's 46% stake, C6 follows the same logic. Gustavo Torres explains that security isn't an added layer, but rather a part of the architecture from the very beginning. Biometrics, multi-factor authentication, and tools like "Secure Location" are prerequisites. "Over time, we've noticed that people, who typically have more than one bank on their phones, are beginning to see that this layer of security that C6 has introduced truly protects the customer," he states.

“Customer experience has to be as simple as possible (with technology, security and journey design behind).”

Gustavo Torres, Head of User Experience and Innovation at C6

Torres explains that, in the financial sector, the perception of security and solidity are two very important factors when it comes to reputation. "And the experience has to be as simple as possible," he says, noting that, behind this apparent simplicity, there's a complex interplay of technology, security, and journey design. "We already have over 100 products and features within the app, and making them work on a mobile screen is a huge challenge," he adds.

AI, increasingly the protagonist

Both Itaú and C6 are betting on Artificial Intelligence as the key player in the next phase. On Itaú's side, "Itaú Intelligence" is being created, focusing on predictive and contextualized solutions. At C6, there's "C6 Assistant," an AI that reads screenshots of WhatsApp conversations and automatically creates a Pix, for example, without the user needing to type anything.

The bank of the future, executives predict, will be more of an assistant than an institution – a kind of financial co-pilot built into the routine.

The rise of digital fraud, such as deepfakes and synthetic identities, requires institutions to adopt a multi-layered security approach, combining biometrics, AI, real-time data analysis, and continuous validation.

This attention is likely to increase even more after what is already being called the largest hacker attack against Brazil's financial system, which occurred in early July. The attack on C&M Software, a technology company that acts as an intermediary between small banks, the Central Bank, and the instant payment system Pix, may have caused losses exceeding R$1 billion.

Security without empathy does not create loyalty

The race, therefore, is against time—and against crime. Whoever best balances technology, experience, and protection will fare better in the war against fraud, preserving the most valuable asset in the financial sector: trust. But idwall's COO warns: security without empathy doesn't build loyalty.

Looking to the future, Mazzei envisions a scenario in which generative AI drives hyper-contextual and advisory services. “The future of banking will be strongly linked to the ability to continuously transform, maintaining a constant focus on customer needs and delivering value through superior digital experiences.” Torres anticipates a shift toward AI as a personal assistant, monitoring spending habits, suggesting portfolio adjustments, or automatically paying bills through voice commands. C6 has been integrating AI into product systems, ensuring LGPD compliance while improving user interaction.

“Bad service causes bank change.”

Raphael Melo, co-founder and COO of idwall

Melo, from idwall, is betting on a digital banking boom in Brazil. In this rapidly changing landscape, the financial sector's reputation will increasingly depend on a delicate balance between security, simplicity, and innovation. "Poor service leads to bank switching," he warns. As digital transformation accelerates, banks that prioritize ethical AI, seamless experiences, and proactive fraud prevention will lead the way, winning the loyalty of increasingly demanding customers.

Brazil has more than 90% of the banked population.

There is 1.27 billion of active accounts. The average is 6,4 accounts per person.

Source: idwall

Clovis Malta is a journalist

clovis.malta@ankreputation.com.br